Start your business with CJdropshipping

All-in-one dropshipping solution provider: product supplies, global logistics, free sourcing, POD, video shooting, and other dropshipping-related services.

CJ Blog

When it comes to European Union taxes, many sellers find it hard to explain, and some even balk at such a big market. However, understanding import duties, customs fees, VAT and other taxes is crucial when importing products from China, especially in a time when trade tensions are at an all-time high. Do tax issues about importing into the European Union really scary? Let’s get this straight today.

Value Added Tax (VAT) of Import Goods from the EU Countries

VAT is a consumption tax in the European Union. In B2C transactions, VAT is always included in the price. For example, if you buy a product online from an EU based online store, the price you pay includes VAT. However, when importing goods from China, you can’t pay the VAT directly to the supplier. Simply because Chinese businesses belong to a different tax system, and are not VAT registered in the EU.

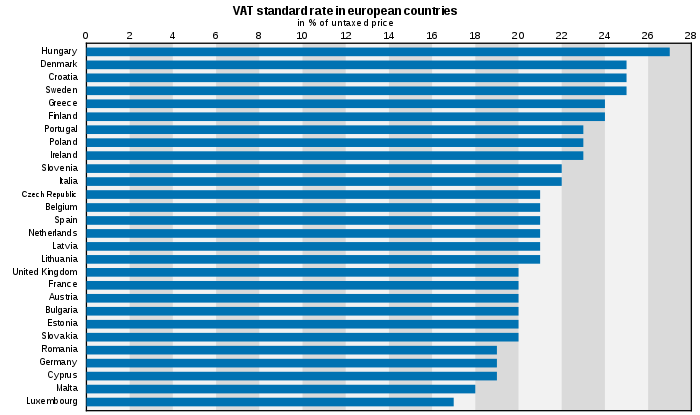

Different VAT rates apply in different EU member states. They can range from 17% in Luxembourg to 27% in Hungary. You can check the VAT rates online, but it’s good to confirm the latest rates with your local VAT office.

https://www.avalara.com/vatlive/en/vat-rates/european-vat-rates.html

Standard rate

Each country has a standard rate applying to most supplies. The 27(except the UK) EU members has the freedom to set their standard VAT rates, but not lower than 15% (The lowest standard VAT rate throughout the EU is 17%). Different VAT rates apply in different EU member states. They can range from 17% in Luxembourg to 27% in Hungary.

Reduced rate

Reduced rates (2 maximum) may apply to a limited variety of sales. Normally they cannot go below 5%.

Super-reduced rate

Some countries apply a super-reduced rate below 5% on some sales. For instance, there’s a super-reduced rate of 4% in Spain applied to certain services, e.g. maintenance of means of transport for people with disabilities.

Zero rate

Some countries apply zero rates on certain sales. In the case of zero rates, consumers don’t have to pay VAT. However, you still have the right to deduct the VAT you’ve paid on purchases directly related to the sale.

Value Added Tax (VAT) of Import Goods from the Non-EU Countries

Import goods from non-EU countries are subject to VAT and duties at the rate applicable in the member state to which the goods are imported. Normally VAT is charged at the border, along with customs duty. In addition to customs duties, you have to pay import VAT, which is calculated according to the customs value of the goods and customs duties.

Import VAT is usually refundable if you register VAT in the country in which the goods are declared. This happens when a VAT refund is made according to the standard VAT refund rules of the country.

Under EU rules, goods imported from non-EU countries are exempt from import VAT if their value is low, that is cargo value must between 10-20 Euros, depending on the cargo import to which EU countries.

Custom Duty

In the European Union, the customs value is the total sum of the products (including development costs paid to the supplier) and shipping to the border, which range from 0%-25%.

Below follows an overview:

*Always included in the customs value

Product cost (as paid to the supplier)

Insurance

Shipping cost to the Port of loading

*Sometimes included in the customs value

Tooling and molds

Product samples

Design services (and related development services) paid to the supplier in China

*Not included in the customs value

Transportation fees within the EU

Fees and services paid in the Port of Loading

All EU member states have the same customs duty rates on products imported from non-EU countries. An importer only pays customs once, for products imported from China. The purpose of Customs Duty is to protect each country’s economy, residents, jobs, environment, etc., by controlling the flow of goods, especially restrictive and prohibited goods, into and out of the country.

Customs duties are not added to products sold within the European Union. Thus, your Spanish and German customers do not need to pay customs on products that have already entered EU territory.

That being said, the customs duty rates vary from products to products. Products that are not manufactured in the EU (e.g. consumer electronics) tend to have lower customs duty rates, sometimes as low as 0%. On the other hand, the opposite is often true for products that are considered part of an important industry in the EU. For example, shoes, have a customs duty of as high as 12%.

Below listed some common products and the respective duty rate in the EU:

Wristwatches: 4.5% (Min: €0.30, Max: €0.80)

Tablet PC: 0%

Solar Panels: 0%

T-Shirts: 12%

Electric Bikes: 6%

LED Bulb Lights: 4.7%

Peanuts: 12.8%

FAQ 1. Do I Need to Pay VAT When Importing From Asia to the EU?

Yes, importers must pay VAT on top of the total sum of the customs value.

VAT is paid to the state, in the country of entry and according to the local rate.

If I import goods to Spain, I pay VAT in Spain, according to Spanish VAT rates. If I am based in the UK, I pay the UK rate, to the HMRC, and so on.

FAQ 2. How Can I Calculate the Amount of VAT ?

Three factors are crucial for calculate the VAT, that is customs value, import duty rate and VAT rate.

Below follows an example:

Customs Value: $10,000

Import Duty: 5% (that is $500)

Sum: $10,000 + $500 =$10,500

VAT Rate: 20% (UK Rate)

Total VAT: $10,500 * 20%= $2100

Total Amount: $10,500 + $2100 = $12,600

FAQ 3. How do I make sure I pay the right VAT amount?

As mentioned above, the VAT is calculated as a percentage of the customs value. Therefore, you have to ensure that the correct customs value is declared on the bill of lading, packing list, commercial invoice and other relevant documents.

FAQ 4. Does the Freight Cost Subject to VAT?

Yes, in the European Union, the customs value includes the shipping costs – up to the arrival in the port of destination. However, any logistics costs that arise within the EU, such as unloading and customs clearance, shall not be included in the customs value. That said, the forwarder will still add VAT on the invoice, but that is paid separately.

FAQ 5. Should I Pay VAT to the Chinese Suppliers?

No, you should not pay EU VAT to any non-EU entity, as they are not VAT registered in the European Union. Neither shall you pay China VAT, as the supplier in China receives a VAT refund when exporting products.

Chat

Share